The auto parts chain’s stock price fell after a disappointing earnings report.

Genuine Parts stock (GPC -19.52%) fell today after the parent company of Napa Auto Parts, Genuine Parts, announced disappointing third-quarter financial results.

Although the company exceeded sales expectations, its final profit was significantly lower. As of 1 p.m. ET, the stock price had fallen 19% on the news.

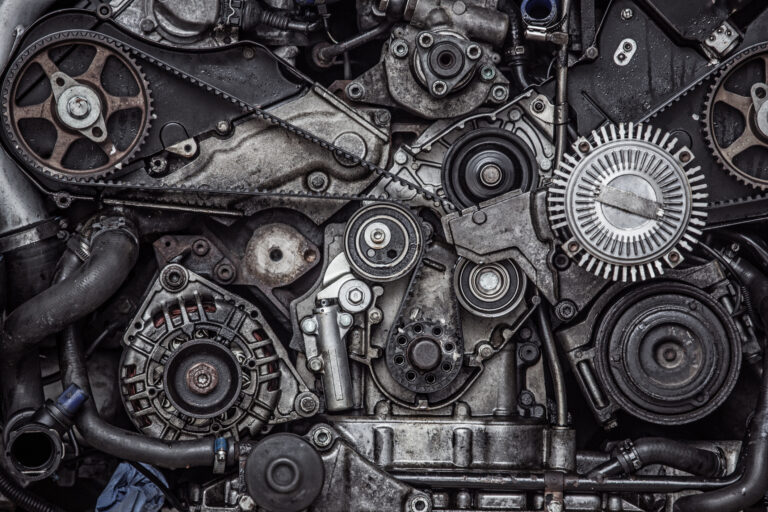

Image source: Getty Images.

Genuine parts apply the brakes

Total revenue for the quarter reported Tuesday rose 2.5% to $5.97 billion, but would have been slightly lower without the acquisition and additional U.S. sales days. This result exceeded expectations of $5.94 billion.

Sales in the core automotive division increased 4.8% to $3.8 billion, while sales in the industrial division decreased 1.2% to $2.2 billion.

The company’s profits fell in the quarter due to weakness in Europe and the industrial sector. Adjusted earnings per share fell to $1.88 from $2.49, well below the consensus estimate of $2.42.

CEO Will Stengel said results were below the company’s expectations, saying, “The external environment will remain challenging through 2024, but once market conditions improve, we will continue to leverage a combination of short-term actions and long-term investments.” “We expect our position to improve,” he added.

What’s next for genuine parts?

Looking ahead, Genuine Parts lowers its earnings per share outlook from $9.30 to $9.50 to $8.00 to $8.20. The company also lowered its sales growth forecast from 1-3% to 1-2%.

Challenges in the industrial sector appear to be causing Napa’s parent companies, AutoZone and O’Reilly Automotive, to underperform this year.

These two companies are consistent winners in this space, and investors in the auto parts industry would be better off picking one of these stocks over Genuine Parts, at least until the company returns to profitable growth. .

Jeremy Bowman has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.