Huge dividend yields can be dangerous. Double-digit dividend yields often indicate a company is in deep trouble, and a series of solid dividend increases cannot drive the stock price higher. At the same time, an automated teller machine business can fuel payments from excess cash flow, which can result in sustained high yields for many years.

Fortunately, there are some perfectly healthy high-dividend stocks on fire right now. Read on to learn how International Business Machines (NYSE: IBM) and Darden Restaurants (NYSE: DRI) fit into today’s income-oriented stock portfolios.

The average American savings account has an annual yield of about 0.5%. The average dividend yield for the S&P 500 (SNPINDEX: ^GSPC) market index over the past five years was 1.6%, but is currently only 1.3%.

With a 3.5% dividend yield on Darden stock and a 3.1% dividend yield on IBM stock, these cash-sharing veterans are on another level. Of these popular asset stores, only individual stocks can beat the government’s long-term inflation target of about 2% a year.

These two well-known names don’t have much in common at first glance. Big Blue is a legend in the computing field, building a promising artificial intelligence (AI) business just in time for the massive AI boom. Darden operates a chain of full-service restaurants including Olive Garden, Bahama Breeze and Longhorn Steakhouse. The company is expanding its international operations while renovating many of its domestic locations. A meeting of apples and oranges.

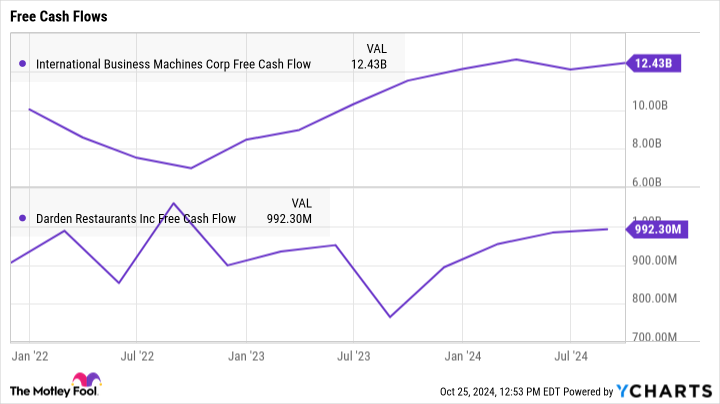

IBM free cash flow chart

But in reality, they have a lot in common in the most important ways. Both businesses are growing sales and earning solid cash profits. They are also committed to sharing their cash flow with investors in the form of strong and growing dividends.

IBM generated $12.4 billion in free cash flow over the past four quarters. It poured 49% of its surplus cash into dividend checks. Darden used 64% of its $992 million free cash flow for the same purpose. Both dividend policies are fully funded by current cash profits and have room to grow without causing a financial crisis.

IBM Price vs. Free Cash Flow Chart DRI Price vs. Free Cash Flow Chart

Finally, Darden and IBM are established leaders in their respective industries and have compelling growth plans for the foreseeable future. However, their stock price looks quite affordable compared to their most popular rivals in the market. If you buy the stock now, you can lock in its impressive dividend yield and have many opportunities to enjoy share price appreciation over the long term.

story continues

Remember, Darden has been around for nearly a century, and IBM is even more experienced. These generous revenue streams should last for decades to come, building shareholder wealth thanks to a generous dividend policy.

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

Amazon: If you invested $1,000 when it doubled in 2010, you would have earned $21,154. *

Apple: If you invested $1,000 when it doubled in 2008, you would have earned $43,777. *

Netflix: If you invested $1,000 when it doubled in 2004, you would have earned $406,992. *

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 21, 2024

Anders Bylund holds a position at International Business Machines. The Motley Fool has positions in and recommends Chipotle Mexican Grill, CrowdStrike, Microsoft, and Wingstop. The Motley Fool recommends International Business Machines and recommends the following options: A long January 2026 $395 call on Microsoft, a short December 2024 $54 put on Chipotle Mexican Grill, and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

2 High Dividend Stocks to Buy Right Now was originally published by The Motley Fool.