Warren Buffett and Cathie Wood typically don’t agree much about portfolio construction. They rarely own the same company.

But there’s one growth stock that both investors love. Nu Holdings (NYSE:NU) is a Latin American fintech company. So we’re investing nearly $1.5 billion in this business. However, many investors have never even heard of this company.

You can take advantage of this ignorance and pick up stocks at incredible discounts.

This growth stock is proving to be a winner

It’s not often possible to buy proven growth stocks at reasonable valuations, even at discounted prices. That’s because once a growth trajectory begins, the market is quick to factor that proven potential into the stock price.

This is part of what makes growth investing so difficult. You can buy and hold stocks that increase their returns by 500% over the holding period. But even if the market were pricing in 600% growth, it could still underperform the market.

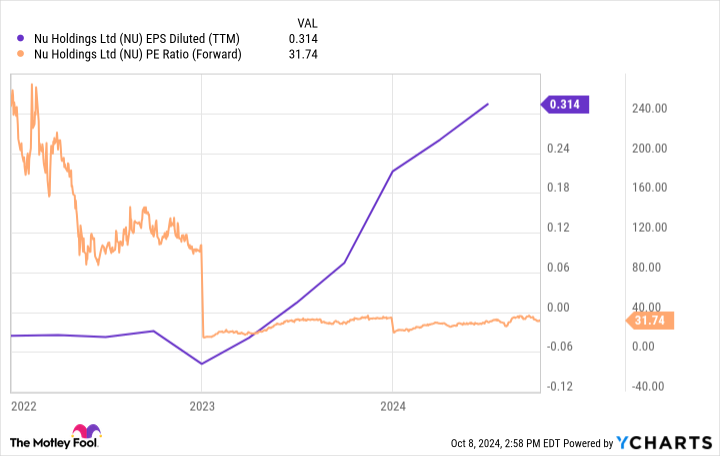

How can you discount a proven growth stock? Let’s take a look at a company the market is ignoring, like Nu Holdings. And that may be why the stock trades at just 32 times forward earnings, even though earnings have soared in recent years.

Nu’s problem isn’t a lack of high-profile investors. Buffett owns just over $1.4 billion in stock through his holding company Berkshire Hathaway, a position he has held since New’s initial public offering in 2021. Cathie Wood also owns approximately 1.5 million shares through her company ARK Invest. No, it’s worth about $20 million.

The problem is not scale. Nu currently has over 100 million customers. The problem is simply that Nu only operates in three countries: Brazil, Mexico, and Colombia. Unless you live in one of these countries, you’ve probably never heard of Nu or used its services.

What is Nu’s business? It is a fintech that provides a range of financial services directly to customers through their smartphones. That may not seem all that revolutionary now, but it was in Latin America in 2013.

At the time, a small number of limp incumbents controlled much of Latin America’s banking industry. Nu has taken the market by storm by offering more advanced services at a lower cost that anyone can use right from the device in their pocket.

There was clearly a lot of pent-up demand. Nu’s customer base grew from virtually zero to more than 100 million people in its first 10 years of business. Additionally, new product lines, including a crypto trading platform, reached over 1 million users in the first month of operation.

story continues

Suffice it to say that Nu’s financial position is strong. Two years ago, the company’s sales had just surpassed $2 billion. Today, that number is approaching $8 billion. Meanwhile, profits have turned positive, and we expect this trajectory to continue for years to come. For example, analysts expect earnings to grow by an average of 54% per year over the next five years.

NU EPS Dilution (TTM) Chart

Should you follow Wood and Buffett into Nu stock?

Nu has a great story, a proven track record, and a reputable platform on which to build. And its valuation (just 32 times forward earnings) is too good to ignore.

Just don’t expect this to go smoothly. After the IPO, Nu stock actually lost 70% of its value in the first year of trading. The stock has since fully recovered, but it’s a good reminder that fast-growing stocks are often at the mercy of market volatility. The multiples assigned to these companies can vary widely depending on market sentiment.

Like Mr. Buffett and Mr. Wood, I am a big fan of New Holdings as an investment. But as with most stocks, it’s patience that ultimately yields the greatest returns. Don’t buy unless you’re prepared to ride out the downturn.

Don’t miss out on this potentially lucrative second chance

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

Amazon: If you invested $1,000 when it doubled in 2010, you would have earned $21,022. *

Apple: If you invested $1,000 when it doubled in 2008, you would have earned $43,329. *

Netflix: If you invested $1,000 when it doubled in 2004, you would have earned $393,839. *

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 7, 2024

Ryan Vanzo has no position in any stocks mentioned. The Motley Fool has a position in and recommends Berkshire Hathaway. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

Warren Buffett and Cathie Wood agree that this growth stock is a buy.Originally published by The Motley Fool