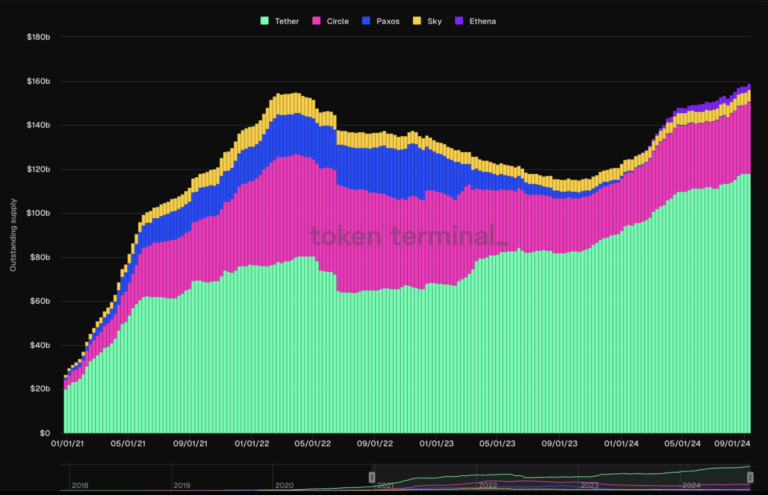

According to Token Terminal, USDT’s market share has increased from 55% to 75% in the past two years.

The supply of Tether-issued stablecoins increased from $65 billion to $118 billion as major rivals struggled.

Tether’s USDT, the largest stablecoin, has not only grown in size but also strengthened its dominant position, now accounting for almost 75% of the stablecoin market value. That’s up from 55% two years ago, data from blockchain data analytics platform Token Terminal shows.

According to Token Terminal, the supply of USDT has nearly doubled over this period, growing from approximately $65 billion to $118.6 billion of the $160 billion stablecoin market. It is the third largest cryptocurrency overall after Bitcoin {{BTC}} and Ether {{ETH}}. The second-largest stablecoin, Circle’s USDC, is less than a third of its size.

Eye stain: @Tether_to has increased its market share from 55% to 75% in the past two years.

1) Tether’s USDT supply is $118 billion

2) Tether’s market share is 75%

3) Tether generated (estimated) $400 million in revenue in the last 30 days pic.twitter.com/IFxXGY0UYg

— Token Terminal | @TOKEN2049 🇸🇬📊 (@tokenterminal) September 16, 2024

Stablecoins are cryptocurrencies whose prices are intended to be pegged to real-world assets such as national currencies or gold, and are an important conduit for the cryptocurrency market, serving as a bridge between fiat currencies and digital assets. It functions as a role. Emerging regions such as Latin America and Southeast Asia are moving away from cryptocurrencies for everything from dollar savings to payments to cross-border transactions, according to a new report by venture capital firm Castle Island and hedge fund Brevan Howard Digital. The activity is becoming increasingly popular. .

Tether held more than $97 billion in U.S. Treasuries and repurchase contracts in reserves as of Q2 2024, managed by New York-based global financial services firm Cantor Fitzgerald. Token Terminal estimates that Tether earns about $400 million a month from the yield on these assets.

Read more: Tether hires PayPal’s government ace as US scrutiny remains unresolved

USDT users use the token due to its network effects, user trust, liquidity, and track record compared to other stablecoins, the report’s research notes.

It was also helped by the woes of its competitors.

USDC was hit hard during the US local banking crisis in March 2023 with the failure of Silicon Valley Bank, one of its reserve partners. Although the token quickly regained its price peg, this event sent investors into its rivals, primarily USDT. The token’s market capitalization has fallen from $50 billion to $35 billion in two years.

the story continues

BUSD, issued by US fintech company Paxos under the brand of crypto exchange giant Binance, was ordered shut down by New York state regulators in early 2023. At the time, BUSD was the third largest stablecoin with a market capitalization of over $20 billion. It will reach its peak at the end of 2022.

New entrants have recently emerged, such as payments giant PayPal’s PYUSD token and blockchain applications Aave and Curve’s decentralized alternative tokens, but they have yet to challenge the leadership of centralized issuers Tether and Circle. .