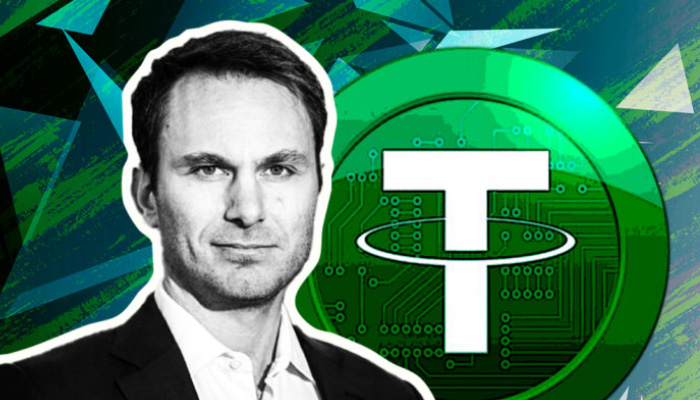

Tether CEO Paolo Ardoino took to the stage at the PlanB event in Lugano, Switzerland, after rumors spread that the US Department of Justice and Treasury Department were investigating Tether. Revealed the breakdown of reserve assets supporting the stablecoin USDT.

Ardoino claims that Tether holds approximately $100 billion in U.S. Treasury securities, 48 tons of gold, and more than 82,000 Bitcoins worth approximately $5.5 billion at current market value. are.

Tether’s chief executive officer said the decision was triggered by a recent Wall Street Journal article that said U.S. authorities were investigating Tether for allegedly violating U.S. sanctions and anti-money laundering regulations. emphasized asset reserves amid fear, skepticism and uncertainty.

The stablecoin company claims that since 2014, Tether has helped law enforcement recover approximately $109 million that was used for illegal activities such as fraud, sanctions evasion, and cybercrime.

Furthermore, Ardoino recently attacked the US for lagging behind other countries in its crypto regulatory policies. This has led to many innovative digital asset companies relocating from the US to more favorable locations. However, Tether’s CEO expressed optimism that the situation will change after the 2024 US presidential election.

In October 2024, Tether’s USDT reached a staggering market valuation of $120 billion. Investors and speculators are interpreting this as a positive sign for the crypto market, which could lead to price increases in the coming weeks and months.

Tether recently gained attention after the Wall Street Journal (WSJ) reported that the stablecoin issuer was the subject of an ongoing investigation by the U.S. government, according to anonymous sources. Tether CEO Paolo Ardoino quickly refuted the allegations, categorically declaring that “WSJ is restating old noise.” Tesar was similarly unreserved in criticizing the study, calling it “grossly irresponsible” and full of “reckless claims.”