(Bloomberg) — Tether Holdings sought to persuade Turkey to use digital assets to overhaul the country’s boron market, a move that would see the crypto industry’s linchpin turn to the commodity for further growth. This is the latest sign of the company’s use of the tea sector.

Stablecoin issuer Tether has pitched to government officials a proposal to use blockchain technology to create digital tokens representing borate minerals, the people said, speaking on condition of anonymity to discuss private talks. I made it. Tether has also floated the idea of setting up a digital asset exchange in the financial capital Istanbul, the people said.

The proposal for Boroncoin falls into the early stages of tokenization, a process that uses a digital ledger to generate a representation of a real-world asset. Proponents argue that tokenization could help modernize some markets.

Boron products are mainly used in the production of ceramics, detergents, fertilizers and glass. Turkey’s monopoly provider, the state-run mining company Eti Maden Isletmeleri Gener Mudlug, estimates that the country holds more than 70% of the world’s reserves. The government predicts sales will be around $1.3 billion in 2024.

Adopting encryption

It’s not clear exactly why Tether has focused on boron or what benefits its proposal would bring, but given that high inflation and a weak lira are spurring widespread adoption of cryptocurrencies, , Turkey is generally an attractive country for digital asset companies. According to data from blockchain intelligence firm Chainalysis, the country saw around $137 billion in crypto inflows in the 12 months to June of this year, making it the seventh-highest in the world.

Turkish government officials said the boron proposal was not actionable at this time, and an official at the country’s Energy Ministry said negotiations with Tether were at an early stage.

Etty Madden general manager Yalcin Aydin is among the people Tether’s local expansion manager Anadolu Aydinli has met with in recent months, according to a LinkedIn post. Others include Turkish Vice President Cevdet Yilmaz and Energy Minister Alparslan Bayraktar. Türkiye’s Energy Ministry and presidential palace declined to comment.

Tether CEO Paolo Ardoino said in a statement that the company is “deeply committed to fostering innovation in Turkey’s digital asset landscape” and is keen to continue exploring new growth opportunities. He said there is.

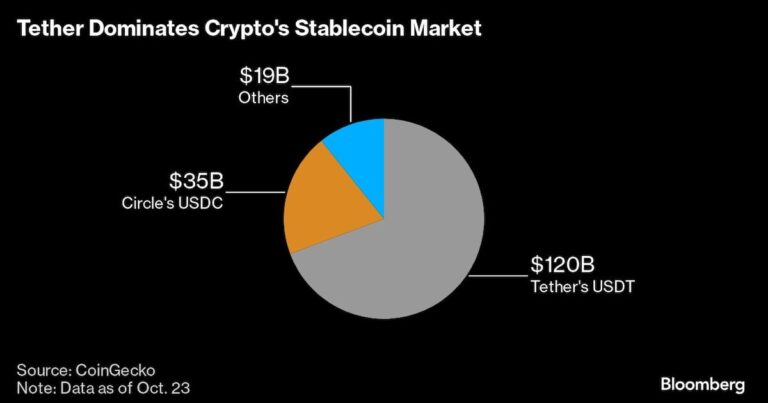

Tether issues the world’s largest stablecoin USDT. USDT is a token designed to hold a constant value of $1, and its circulation has soared to $120 billion. Digital assets are a great place to store funds for use in cryptocurrency trading.

The company is also increasingly touting surrogate dollars as a cheaper and faster way to make payments by curbing the use of traditional bank rails, especially in emerging countries where U.S. dollars may be in short supply.

extension manager

Aydinli is among Tether’s fellow expansion managers around the world, many of whom partnered with the company last year, according to his LinkedIn profile. Adoption in countries such as Venezuela, the Philippines, Thailand, Indonesia, and the United Arab Emirates, as well as Africa and Latin America, underscores the company’s ambitions to expand beyond its crypto roots.

“There is growing interest in using stablecoins such as USDT for payments, especially cross-border payments,” said Angela Ang, senior policy advisor at blockchain intelligence firm TRM Labs.

Tether is already considering lending to commodity trading companies to leverage some of the profits from its stablecoin business. These meetings included discussions on how USDT can penetrate deeper into hard asset payment flows. Tether put the funds backing its USDT dollar peg into investments such as U.S. Treasuries, and the interest earned drove record profits of $5.2 billion in the first half of 2024.

There are signs that USDT will gain traction among commodity producers and brokers in countries such as Venezuela and Russia that are subject to myriad sanctions by the United States and lack easy access to the global banking system. . The changes pose a challenge for regulators around the world seeking to police the flow of money.

–With assistance from Sidhartha Shukla and Suvashree Ghosh.

©2024 Bloomberg LP