Stripe Inc. today announced plans to acquire Bridge Ventures Inc., a startup with a platform for processing stablecoin transactions.

The companies did not disclose financial terms of the deal. But one person told Forbes that Stripe is paying $1.1 billion for Bridge. This is more than five times the valuation the startup reportedly received after a funding round earlier this year.

Many businesses need the ability to process digital payments, but lack the technical resources to build the necessary software. One reason this task is complex is that payment processing software must comply with a long list of financial regulations and cybersecurity requirements. There are other challenges as well, such as the need to add integration with external banking infrastructure.

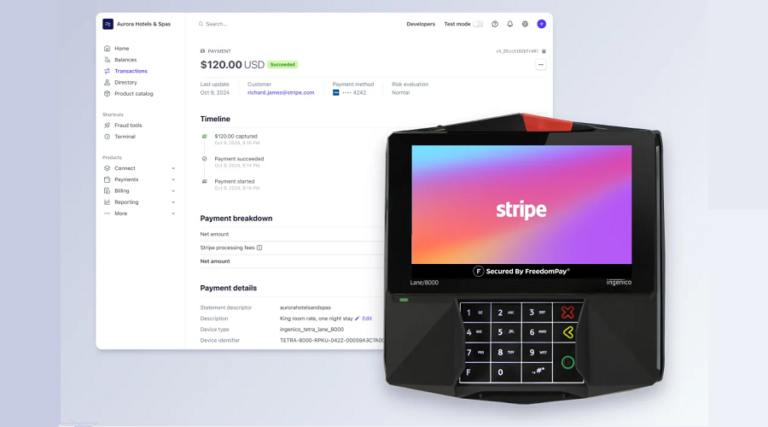

By automating these tasks for developers, Stripe has established itself as one of the most valuable startups in the technology industry. Instead of creating a payment processing system from scratch, software teams can easily integrate our platform into their applications using a few lines of code. Stripe takes care of the regulatory compliance chores and other tasks associated with moving funds.

Bridge has a similar business model, but with a narrower focus on stablecoins. These are digital assets pegged to currencies or financial instruments. Bridge’s platform allows developers to build applications that process stablecoin transactions with a fraction of the work normally required for tasks.

Some companies are using the startup’s software to accept customer payments in stablecoins. Some people rely on Bridge to process cross-border transactions. Additionally, the company offers a service that allows developers to issue their own stablecoins and invest users’ funds in U.S. Treasuries.

Bridge was founded in 2022 by CEO Zack Abrams and chief technology officer Sean Yu. The two previously launched payment app Evenly, which was acquired by Block Inc. in 2013. Mr. Abrams went on to become head of consumer business at Coinbase Inc., while Mr. Yu worked at Airbnb Inc., Square Inc. and other technology companies.

Today’s acquisition comes several months after Stripe added cryptocurrency support to its payment processing platform. The company launched a similar feature in 2018, but had to discontinue it due to technical issues.

The stablecoin sector is the latest in a series of markets where Stripe has established a presence to sustain revenue growth. The company, which reportedly generates more than $2.5 billion in annual revenue, has previously launched tools to automate accounting tasks and ease the process of incorporating a business. Stripe also provides data analytics capabilities for processing financial logs from the platform.

Stripe plans to complete its acquisition of Bridge in the coming months.

Image: Striped

Your upvote is important to us and helps us keep our content free.

Your one click below will support our mission of providing free, deep and relevant content.

Join our community on YouTube

A community of over 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies Founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many other celebrities and experts. Please join us.

“TheCUBE is an important partner for the industry. You all really participate in our events. We really appreciate you coming and we hope you value the content you create as well. – Andy Jassy

thank you