(Bloomberg) – Stocks fell late on pessimistic news from some major U.S. companies as traders also speculated on the possibility that the Federal Reserve may slow its pace of interest rate cuts.

Most Read Articles on Bloomberg

The $600 billion exchange-traded fund (ETF) that tracks the S&P 500 (SPY) reeled after the close of regular trading. Texas Instruments, the largest analog chip maker, gave a weak outlook despite beating expectations. Starbucks has withdrawn its 2025 outlook after sales declined for three consecutive quarters. McDonald’s Co. plunged after its Quarter Pounder was linked to an E. coli outbreak in the United States.

Stock prices ended the day slightly lower, with the S&P 500 falling for the first time in six weeks. Citigroup strategist Chris Montague said exposure to the gauge is at a historic 10% decline. Long positions in futures linked to the benchmark appear to be “particularly widening.”

“We are not saying investors should start reducing their exposure, but the risk of positioning certainly increases when the market expands like this,” they said.

The S&P500 was almost unchanged. The Nasdaq 100 rose 0.1%. The Dow Jones Industrial Average was little changed.

The yield on the 10-year US Treasury note is hovering around 4.20%. The euro hit its lowest level since early August on expectations that the European Central Bank will continue to cut interest rates. Oil rose as traders tracked tensions between Israel and Iran. Gold rose to a new record.

While Fed officials are sounding cautious about the pace of future rate cuts, Wall Street is refraining from betting on aggressive policy easing as the U.S. economy remains strong. Rising oil prices and the prospect of a widening budget deficit after the next presidential election are further exacerbating market concerns. Since the end of last week, traders have reduced the rate they expect the Fed to cut by September 2025 by more than 10 basis points.

“Of course, rising yields are not necessarily negative for stocks,” said Matt Maley of Miller Tabak. “Honestly, as bond yields have continued to rise over the past month, stocks “But given how expensive the market is today, these higher yields could have some impact.” There will be problems in the stock market in the near future. ”

story continues

A series of better-than-expected data pushed Citigroup’s U.S. Economic Surprise Index to its highest level since April. This gauge measures the difference between actual releases and analyst expectations.

“The market is already pricing in a slower pace of cuts on the back of September’s strong economic data,” said Lauren Goodwin of New York Life Investments. “If the Fed can push interest rates toward 4% (still above what most people believe is the ‘neutral’ rate), the stock market rally could continue. If it breaks down, it will likely lead to more volatility in the stock market.”

The last time U.S. Treasuries sold this much after the Fed started cutting interest rates, Alan Greenspan engineered a rare soft landing.

Two-year Treasury yields have risen 34 basis points since the Fed cut interest rates for the first time since 2020 on September 18th. Yields similarly rose in 1995, when Greenspan’s Fed succeeded in cooling the economy without causing a recession.

In previous rate-cutting cycles dating back to 1989, two-year Treasury yields have fallen by an average of 15 basis points a month after the Fed began cutting rates.

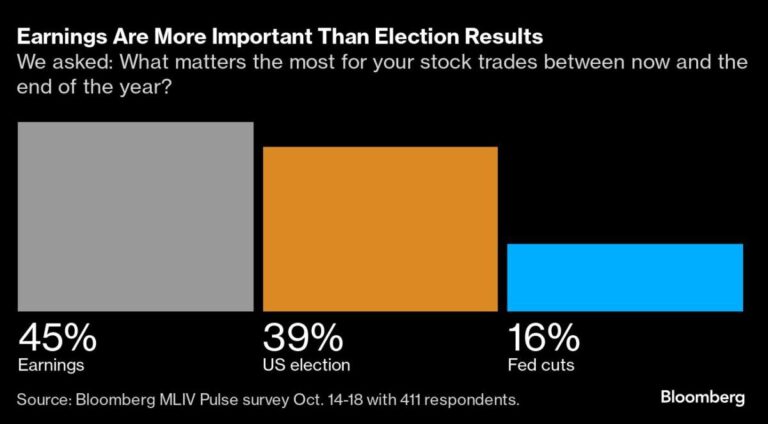

Meanwhile, the International Monetary Fund said the US election poses “high uncertainty” for markets and policymakers, given the widely differing trade priorities of the candidates. This gap creates the risk of another round of volatility in global markets, similar to the rattling sell-off in August.

“The president doesn’t control the market,” said Karrie Cox of Ritholtz Wealth Management. “Over time, the common denominator in the stock market has become the economy and profits, not who is in the Oval Office. Be prepared for market mood swings as Election Day approaches. Remember that storms often dissipate quickly.

As earnings season approaches, U.S. companies are benefiting from the best stock market in five years as they beat profit estimates that were lowered heading into the season.

S&P 500 companies with better-than-expected third-quarter profits outperformed the benchmark by a median of 1.74 percentage points on earnings day, according to data compiled by Bloomberg Intelligence. This is the highest percentage on record for BI dating back to 2019.

At the same time, companies that missed forecasts underperformed the S&P 500 by a median of 1.5 percentage points, less negative performance than the 1.7 percentage points seen in the second quarter, the data showed.

“This earnings season, we’re paying attention to what companies are saying about inflation and the economy,” said Megan Hornman of Verdence Capital Advisors. “Additionally, their view on interest rates, especially if the Fed can’t be as aggressive as the market is pricing in at this point. It’s good that analysts are getting more realistic about earnings growth in 2025. However, we believe that 15% profit growth is still too optimistic given the expected slowdown in economic growth in 2025.

Company highlights:

Verizon Communications Inc. reported lower-than-analyst forecasts for sales, weighed down by weak sales of hardware such as mobile phones.

3M raised the lower end of its 2024 profit forecast and reported profits that beat analysts’ expectations as its productivity drive gains momentum.

General Motors reported better-than-expected results in its latest quarter and raised the lower end of its full-year profit forecast, signaling solid U.S. demand for its most profitable cars even as the broader market softens.

General Electric Co.’s sales fell short of Wall Street expectations last quarter, dampening enthusiasm for an improved profit outlook as the jet engine maker grapples with supply chain constraints that are weighing on deliveries.

Kimberly-Clark, which owns the Scott brand of toilet paper, has lowered its full-year organic sales forecast after announcing lower-than-expected financial results.

Shares of Philip Morris International soared on Tuesday after the company predicted higher-than-expected profits this year thanks to a surge in demand for its gin and nicotine pouches in the United States.

Lockheed Martin Corp.’s third-quarter sales were lower than expected, affected by weaker aircraft sales and ongoing issues with the F-35 fighter jet program.

L’Oréal SA posted disappointing sales last quarter as the beauty company struggled with weak consumer demand in China.

This week’s main events:

Canadian interest rate decision Wednesday

Eurozone consumer confidence Wednesday

US used home sales Wednesday

Boeing, Tesla and Deutsche Bank earnings results Wednesday

Fed Beige Book, Wednesday

U.S. new home sales, unemployment claims, S&P Global Manufacturing and Services PMI, Thursday

UPS, Barclays earnings, Thursday

Fed’s Beth Hammack speaks Thursday

US Durable Goods, University of Michigan Consumer Sentiment, Friday

The main movements in the market are:

stock

The S&P 500 was little changed as of 4 p.m. New York time.

Nasdaq 100 rose 0.1%

The Dow Jones Industrial Average is little changed.

MSCI World Index falls 0.3%

currency

Bloomberg Dollar Spot Index little changed

The euro fell 0.2% to $1.0794.

The British pound was almost unchanged at $1.2980.

The Japanese yen fell 0.2% to 151.13 yen to the dollar.

cryptocurrency

Bitcoin fell 0.4% to $67,428.76.

Ether fell 1.8% to $2,625.8.

bond

The 10-year government bond yield was almost unchanged at 4.20%.

Germany’s 10-year bond yield rose 4 basis points to 2.32%.

The UK 10-year bond yield rose 3 basis points to 4.17%.

merchandise

West Texas Intermediate crude rose 2.2% to $72.09 per barrel.

Spot gold rose 1.1% to $2,748.60 an ounce.

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP