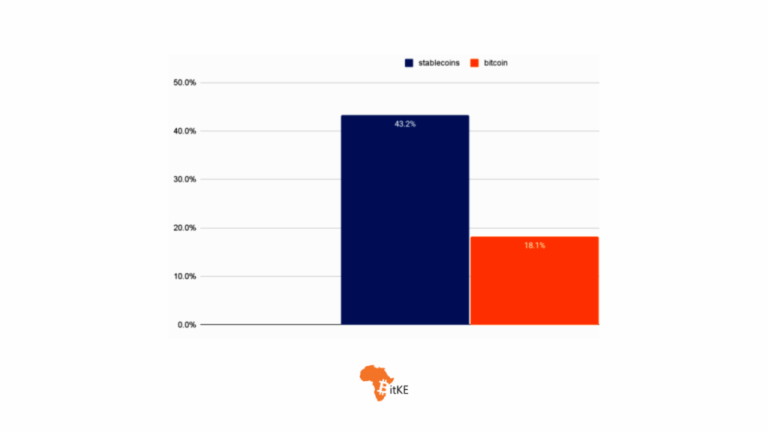

According to the latest 2024 Cryptocurrency Geography Report by Chainalysis, stablecoins currently account for approximately 43% of total crypto trading in sub-Saharan Africa.

The main driver for stablecoin adoption in Africa is the foreign exchange (FX) crisis that is hitting many countries.

“About 70% of African countries are facing currency shortages, and businesses are struggling to access the dollars they need to operate,” said Yellow Card CEO Chris Morris. said.

In countries like Nigeria, where the value of the local currency Naira (NGN) has fallen significantly, stablecoins provide a much-needed alternative.

“The banks don’t have dollars, the government doesn’t have dollars, and even if they had dollars, they wouldn’t give us dollars,” Morris pointed out.

As shown below, inflows of small and medium-sized stablecoins measured at less than $1 million tend to coincide with a decline in the value of the naira.

According to Chainalies, Ethiopia has become the fastest growing retail-scale stablecoin remittance market on the continent, with year-over-year (YoY) growth of 180%.

Recall that Ethiopia’s local currency, the Birr (ETB), depreciated by 30% in July 2024 following the government’s decision to ease currency controls.

🇪🇹Regulation |Ethiopia strengthens reforms towards free market economy, fluctuates exchange rate with major policy shift

According to another statement from the Prime Minister: #EthiopiaAbiy Ahmed, New exchange rate system aims to adjust Ethiopia’s currency… pic.twitter.com/q7i8aBqSzH

— BitKE (@BitcoinKE) July 29, 2024

This devaluation is expected to increase interest in stablecoins.

According to Chainalysis, stablecoins have become essential for companies involved in international trade.

Stablecoins enable transactions that would otherwise be delayed by currency shortages, benefiting both small importers buying goods abroad and large multinational corporations importing raw materials from Europe.

“Stablecoins are a proxy for the dollar,” Morris said.

“If you can participate in USDT or USDC, you can easily exchange it for hard dollars elsewhere.”

Nigeria has emerged as a global leader in cryptocurrency adoption, ranking 2nd overall in the Chaina Analysis 2024 Global Adoption Index, with the country expected to receive approximately $59 billion in cryptocurrency adoption from July 2023 to June 2024. Received cryptocurrency value.

Similar to Ethiopia, Ghana, and South Africa, stablecoins are also a major part of Nigeria’s crypto economy, accounting for around 40% of the region’s total stablecoin inflows, which is higher than that of all sub-Saharan Africa. By far the most common among them.

“Cross-border remittances are the primary use case for stablecoins in Nigeria,” said Moyo Sodipo, COO and co-founder of the Nigerian exchange Busha.

“It’s much faster and more affordable.”

With the growing importance of stablecoins, Nigeria has seen a significant surge in DeFi, reflecting a larger trend for sub-Saharan Africa to lead the world in DeFi adoption. Nigeria is at the forefront of this movement, with DeFi services expected to be worth more than $30 billion by 2023.

See also

🇳🇬Report | #Nigeria Ranked 2nd in the world #DeFi The only African country to rank in the top 20 on Chainalysis’ 2024 Crypto Adoption Index

“If we look at year-over-year growth in terms of service types, we see a significant increase in DeFi activity in sub-Saharan Africa and Latin America. pic.twitter.com/foXhFCjaM1

— BitKE (@BitcoinKE) September 13, 2024

DeFi platforms are offering Nigerians new opportunities to earn interest, obtain loans, and participate in decentralized transactions in addition to the traditional financial system.

“DeFi is a key growth area as users seek ways to maximize their profits and access financial services not otherwise available,” Sodipo said.

follow me × For the latest posts and updates

Join and interact with the Telegram community

_______________________________________________

_______________________________________________