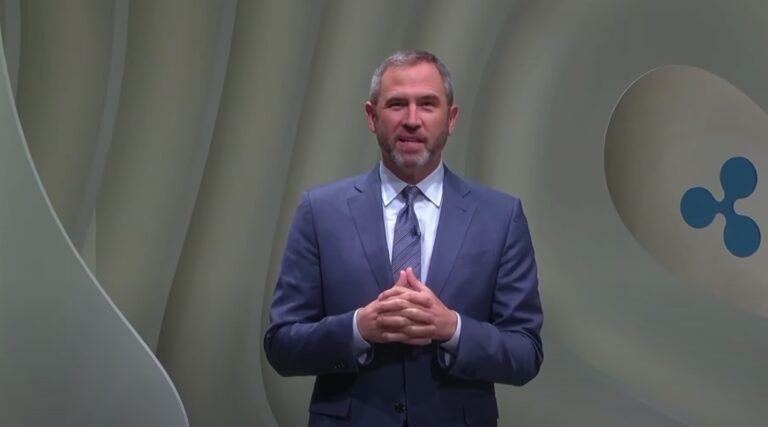

Ripple Labs CEO Brad Garlinghouse believes his company’s XRP spot exchange-traded fund (ETF) will become a reality. In a conversation with Sonali Basak and Tim Stenovec on Bloomberg TV on October 23, 2024, Garlinghouse highlighted the growing interest from institutional investors and retailers in cryptocurrencies. , suggested that XRP will follow in Bitcoin’s footsteps.

He said there are now clear signs that both asset managers and the broader market are considering XRP’s potential within regulated investment vehicles. He observed that this move marks another important development for XRP.

As Garlinghouse explained, the U.S. Securities and Exchange Commission (SEC) was initially reluctant to approve a spot Bitcoin ETF, but it was eventually approved after proving there was significant demand. He said the Spot Bitcoin ETF has attracted approximately $17 billion since its launch in January 2024. “This is a very clear indication that there is demand from financial institutions. There is demand from retail businesses that want access to this asset class,” he said, adding that interest is not just limited to Bitcoin. I showed that.

In Garlinghouse’s view, the introduction of spot Bitcoin ETFs is part of a broader trend affecting the crypto market as a whole. The CEO said the question is not whether to introduce an XRP ETF, but when. He suggested that even an ETF with a diversified basket of cryptocurrencies containing five to six different assets is being developed, reinforcing the trajectory towards greater institutional involvement in the crypto sector. .

While discussing the performance of existing crypto ETFs, Garlinghouse also mentioned how Bitcoin ETFs compare to other ETFs such as Ethereum. He acknowledged that Bitcoin’s dominance in the crypto market has led to increased inflows to Bitcoin ETFs, but defended the performance of non-Bitcoin ETFs. “I disagree that there is no (interest). I think the (Ethereum) ETF is doing very well,” he asserted, pointing to the comparable market power of Bitcoin and Ethereum.

Garlinghouse emphasized that while the new ETF may not yet match Bitcoin inflows, it is still performing well relative to its market presence. He highlighted the enthusiasm and support for the XRP ecosystem both in the United States and abroad, noting that the community continues to grow. “I think that will put upward pressure on the prices of various cryptocurrencies, including XRP,” he said, predicting a positive impact on valuations as institutional investor participation increases.