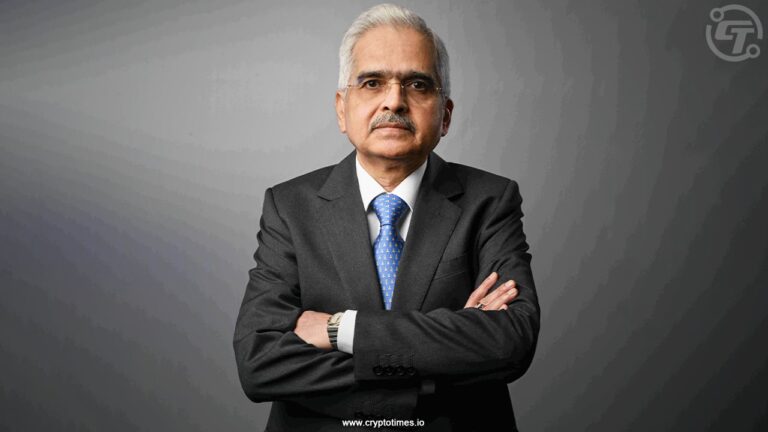

Reserve Bank of India (RBI) Governor Shaktikanta Das on Sunday slammed stablecoins and other cryptocurrencies at the G30 39th Annual International Banking Seminar in Washington, DC, calling payment systems “private money”. ‘ expressed discomfort with the idea of ruling and ending local government sovereignty.

Das praised the concept of Central Bank Digital Currency (CBDC) and hailed it as the future of fiat currencies, saying that India has received a positive response to the CBDC pilot project. Das’s comments came in the wake of the Indian government’s deliberation of a discussion paper on virtual currency regulation. India has one of the highest taxes on crypto income, even though it remains unregulated, and government plans to ban crypto entirely to promote CBDC There were also media reports that this was a possibility.

“It’s interesting how we need to add the prefix “stable” before stablecoins. I have fundamental doubts and very strong concerns about stablecoins. Stablecoins are private money, but are you comfortable allowing stablecoins to dominate the payments ecosystem, or should we allow fiat currencies issued by sovereign governments to do the same?” Das said. said.

Das also said that private currencies such as stablecoins and cryptocurrencies could pave the way for a few multinational corporations to dominate the payments ecosystem, thereby leading to a loss of monetary sovereignty for local governments. emphasized. Readers can watch the entire conference on YouTube.

“Secondly, fiat currencies have no settlement risk. When you pay someone a CBDC, it’s final, and that money is backed by governments and central banks.” No collateral or finality required. . What big advantages do stablecoins have compared to CBDCs? I’m very uncomfortable with them and frankly don’t see any benefit and think there are a lot of risks. I feel it. “We are seeing a situation where only large companies based in certain countries are dominating the ecosystem, raising major concerns about governments losing sovereign control over their monetary systems,” Das said.

Das also praised CBDCs and stressed the need to promote them as the future of paper currency with several use cases including faster cross-border payments.

“India is one of the pioneering countries where the United Payment Interface (UPI) has ensured high efficiency in payment systems. Here, we focus on the interoperability between UPI and CBDC. India has already launched a pilot project on CBDC two years ago, and there has been a positive response to it. However, we are not in a hurry to roll out the CBDC nationwide as we would like to conduct a trial first and be completely convinced about the design, functionality, security and robustness of the CBDC,” Das said. spoke.

Also read: India becomes second largest market for virtual assets by trading volume