Bitcoin’s price growth has stalled in recent months since its meteoric rise heading into 2024 (although one Wall Street giant is secretly predicting that Bitcoin will soon soar).

$3,000 that gives you unparalleled access to Web3’s community of top entrepreneurs, creators, investors, premium networking, priority access to global events, free access to Forbes.com and Forbes CryptoAsset & Blockchain Advisor newsletters, and more Get more benefits. Apply now!

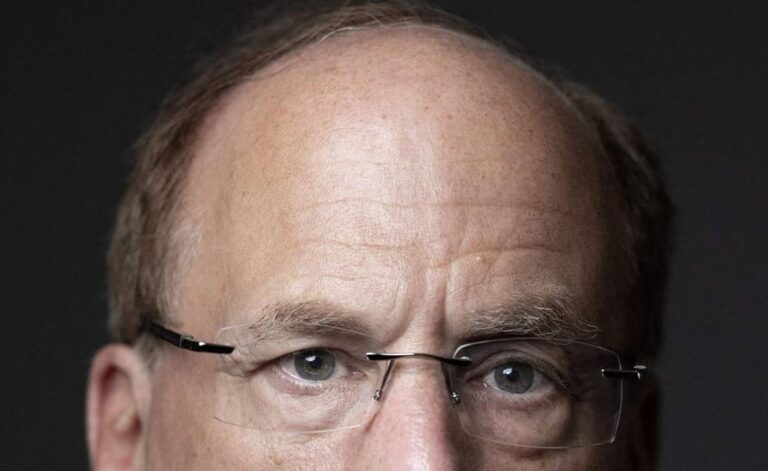

Bitcoin price has retreated from its all-time high of over $70,000 per Bitcoin in 2024, reached following a wave of interest in BlackRock’s Spot Bitcoin Exchange Traded Fund (ETF), reaching $11 trillion. Larry Fink, CEO of Dollar Asset Manager, said the US Federal Reserve issued a “crazy” warning last week.

Now, as MicroStrategy’s Michael Saylor reveals his $100 trillion “end goal,” Fink outlines plans for Bitcoin, Ethereum, and cryptocurrencies, and says that “digitizing the dollar” is “under discussion.” ” is predicted to become.

Sign up for your free CryptoCodex today. A daily 5-minute newsletter for traders, investors, and crypto enthusiasts to stay informed and ahead of bull runs in the Bitcoin and crypto markets.

Forbes JP Morgan quietly dumped $7.5 trillion in Bitcoin Donald Trump and the Federal Reserve’s stock market crash By: Billy Bambrough

BlackRock CEO Larry Fink predicted that Bitcoin would spark a digital revolution on Wall…(+)Street and send Bitcoin prices skyrocketing…

AFP (via Getty Images)

“We believe Bitcoin is an asset class in its own right and an alternative to other commodities like gold,” Wall Street said last year, introducing a full-fledged spot Bitcoin ETF to the U.S. market. Fink, who led the way, spoke during BlackRock’s third quarter. In the earnings announcement, he predicted that Bitcoin, Ethereum, and cryptocurrencies would “overlap” with artificial intelligence.

“Therefore, I think the scope of this form of investment will expand. Secondly, the role of Ethereum as a blockchain could grow dramatically. Therefore, we will see more acceptance related to these assets. If we can create possibilities, more transparency, more analysis, it will be expanded.” ”

Bitcoin and Ethereum reach $11 trillion in assets under management at BlackRock for the first time in the third quarter through a new crypto ETF that provides exposure to cryptocurrencies without the risk of trading with exchanges or self-custody contributed to the breakthrough. BlackRock’s IBIT has had $21.7 billion in net inflows since January, far outpacing the $10 billion inflows to Fidelity’s second-largest Spot Bitcoin ETF, according to SoSoValue data.

Anthony Scaramucci, founder of hedge fund SkyBridge Capital, said: “It’s crazy to see a major company like BlackRock or Fidelity launch a Bitcoin ETF and start pitching the idea to institutional and individual investors.” I think it’s a positive thing,” he said in an interview with investment platform Saxo. —Set a target price for Bitcoin at $170,000.

The proliferation of spot Bitcoin ETFs on Wall Street this year is the first step in what Fink called a digital “revolution” when he revealed his crypto ambitions for BlackRock last year. It includes radical new blockchain-based alternatives. USD.

Sign up for CryptoCodex today. A free daily newsletter for anyone interested in cryptocurrencies.

Forbes Michael Saylor reveals impact of $100 trillion microstrategy ‘endgame’ as Bitcoin price suddenly soars Author: Billy Bambrough

This year, with support from BlackRock, the price of Bitcoin skyrocketed to an all-time high of over $70,000 per Bitcoin.

forbes digital assets

“We truly believe that the market for these digital assets will grow,” Fink said, pointing to BlackRock’s experience in the mortgage market, which has grown with data and analytics. “And you’ll see how each country expands.” It’s a completely different asset than Bitcoin itself. But I believe that’s what we’ll witness as we build better analytics. ”

Mr. Fink called the attempts to digitize currencies in India and Brazil a “huge success.”

Mr. Fink asked, “How do you see the role of digitalization of the dollar (in the United States)? And what role will it play?” “That’s a completely different question related to Bitcoin and other similar things, for example. But all of that will be discussed.”

The debate over digital dollars, also known as central bank digital currencies (CBDCs), began in 2019 with Facebook (now Meta) planning to issue a Bitcoin-inspired digital currency before being shut down by regulators. The announcement caused excitement.

The potential of a digital dollar is often compared to the digital yuan, which is already widely used in China and used to monitor people’s daily transactions, but this has only raised privacy concerns. It also raises questions about how it will affect the commercial deposit-based financial system.

Federal Reserve Chairman Jerome Powell said the Fed would not create a digital dollar without explicit permission from Congress.