Circle guarantees social status regarding the issuance of USDC and informs you of changes to redeem stablecoins.

From now on, all cashouts with a counter value over $2 million will be subject to a fee ranging from 0.03% to 0.1%.

This change is primarily aimed at institutional investors and large holders of USDC.

Circle changes USDC fee policy: from 0.03% to up to 0.1% for institutional investors

According to the latest crypto news, technology company Circle has just increased USDC redemption fees.

This decision only affects users who make stablecoin redemption transactions of more than $2 million through the Circle Mint platform.

For those who don’t know, redemption is the act of crypto resources being returned (burned) to the issuer in exchange for fiat currency.

From now on, fees for this action will range from a minimum of 0.03% to a maximum of 0.1% for larger cashouts.

This is the second time in the past year that Circle has changed its refund terms, having in February introduced a fee for refunds over $15 million.

Traders can redeem USDC without fees if they are willing to wait up to two days before transferring.

Scoop: Circle has increased USDC redemption fees for the second time this year. Traders complained to the issuer that the token’s usefulness was decreasing https://t.co/Rp1lCwVtB4

— Emily Nicolle (@emilyjnicolle) October 29, 2024

This fee increase primarily concerns institutional investors who need to periodically perform redemptions in fiat currency.

To redeem 15 million USDC, you could end up paying up to $15,000. This is an exorbitant amount considering other competing services are almost free.

As reported by anonymous sources, the revisions seek to bring more liquidity to Circle’s coffers and capitalize on increased participation from institutional investors.

We are also reminded of how Circle is positioning itself for an initial public offering (IPO) and listing on a US exchange by 2025.

Its Wall Street entry could attract capital from a variety of large companies, but it would have to pay fees to Circle to use its stablecoin services.

The fintech company filed for an IPO in January and was awaiting approval from the U.S. Securities and Exchange Commission (SEC).

Circle pricing remains affordable for small users

Although the fees charged by Circle are starting to become detrimental for institutional investors, small traders can still take advantage of the cost-effectiveness of USDC.

Indeed, stablecoins can be exchanged for free on-chain from one address to another. However, there are only gas fees depending on the blockchain to which the stablecoin belongs.

In Layer 2 networks, transaction fees can be as little as a few cents.

For deposits to CEX, fees are in line with those of other stablecoins and are rarely more than $2-3, regardless of the amount.

For redemptions on Circle Mint, transactions under $2 million remain cheap, and we’re seeing an increase in transactions focused solely on financial institutions.

In all of this, small users can also take advantage of the scalable aspect of USDC, with exchanges taking place in seconds on some chains such as Sui.

User “Bigfloater74” took just 2 seconds to transfer on-chain resources from Coinbase to his wallet.

Just sent $USDC from @coinbase to me @sui network wallet.

It took 23 seconds with no network charges.

Yesterday morning, I transferred fiat currency from my bank. It hasn’t arrived yet and will probably only arrive on Monday!

Tired of continuing to rely on slow and expensive products… pic.twitter.com/oV41oYgFmd

— SM Big Floater🔌📺 (@bigfloater74) October 26, 2024

We also remind you that there are merchants within the Circle community who accept USDC payments for free and with zero fees.

According to the website acceptusdc.com, the global adoption of stablecoins has improved significantly.

A growing number of small merchants are accepting payments in cryptocurrencies without customers paying fees to transfer funds.

All exchanges are also processed 24/7 and there are no special waiting times unless there are technical issues with the reference blockchain.

It is clear that while USDC remains a very viable option for retailers, regulatory compliance makes it almost a mandatory option for financial institutions.

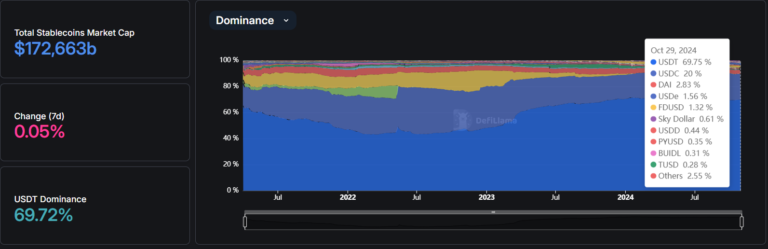

Stablecoin market dominance: USDC ranks second after USDT

Despite Circle’s increased fees for large cash outs, USDC does not appear to have recorded a loss of share in the stablecoin market.

The competitive scenario has not changed in recent months and the latest news did not lead to a sell-off in favor of other more economical options.

USDC remains in second place in the ranking of the largest stablecoins, with a market share of around 20% and a capitalization of $34.5 billion.

The first place is clearly USDT. It has $120.3 billion and 69.7% control and is the most frequently used in the entire blockchain space.

USDC and USDT together dominate the stablecoin market, capturing nearly 90% of all value within the market.

DAI, USDe, and FSUSD are in the top five with a small share, but they have enviable values that are completely worthy of respect from other competitors.

The total market capitalization of all stablecoins in circulation, both overcollateralized and algorithmic, totals $172.6 billion.

Since the beginning of 2024, USDC’s controlling share has increased by 1.5%.

Source: https://defillama.com/stablecoins

When it comes to USDC volumes and transactions, the scenario seems to have changed significantly since the beginning of the year.

Networks such as Base, Arbitrum, and Polygon have seen a significant increase in activity centered around Circle stablecoins.

On the contrary, Avalanche and Ethereum have seen a significant decline in operations, giving these networks an advantage over competitor USDT.

Source: https://dune.com/KARTOD/stablecoins-overview

Source link