(Bloomberg) — For the second time in less than a year, Circle Internet Financial Ltd. has increased the fees it charges to convert USDC stablecoin holdings into cash.

Most Read Articles on Bloomberg

Redemption of USDC through the Circle Mint platform was previously free and unlimited. In February, Circle introduced fees on swaps over $15 million. Currently, additional fees apply to users seeking near-instant redemption of USDC if the amount exceeds $2 million per day. These fees start at 0.03% per transaction at their threshold and increase up to 0.1% per tranche for redemptions over $15 million.

“Circle Mint’s redemption options support the availability of instant liquidity around the world, similar to banks and other financial institutions that charge fees for speed and service,” a Circle spokesperson told Bloomberg News. said in a statement provided to.

Traders can choose to redeem their USDC for free if they don’t mind waiting a couple of days before receiving their cash. Circle introduced a new tiered pricing structure in late September, said the people, who asked not to be identified sharing personal information. Customers have expressed concerns to Circle that rising fees are making USDC less attractive for transactions, the person said.

Competition among stablecoins has increased this year as new issuers flood the market and traditional financial institutions like BlackRock Inc. look for ways to increase the use of their tokens as collateral. There is.

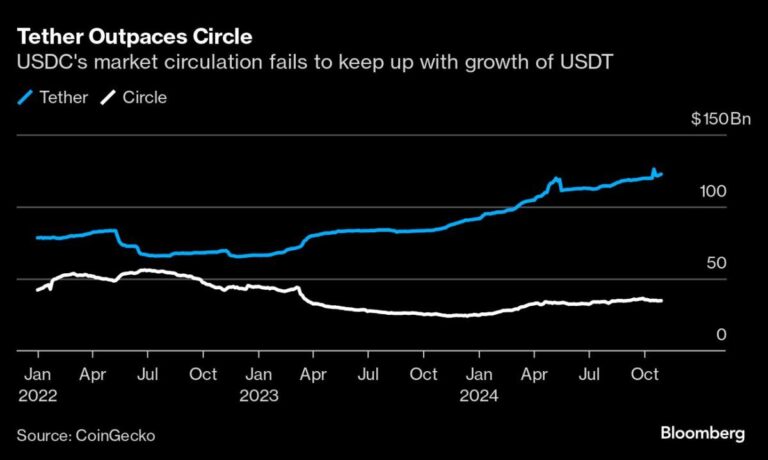

Circle has also struggled to keep up with the growth of much larger rivals. Tether Holdings’ USDT token, which accounts for about 70% of the stablecoin market, reached a record $120.6 billion in circulation this month. According to its website, Tether charges a 0.1% fee for minting or redeeming USDT over $100,000 with issuers.

Circle continues to pursue plans for a stock market listing, the company’s CEO Jeremy Allaire told Bloomberg News this month after confidentially filing a draft registration with the Securities and Exchange Commission in January. . The company previously attempted to go public through a merger with a blank check company. That contract was canceled in 2022.

Circle stock traded on the secondary market this month at a valuation of about $4.5 billion, according to Bulletin data. That’s down about 42% from its $7.7 billion price tag in 2022, when it raised about $400 million from investors including BlackRock Inc. and Marshall Weiss LLP, Bulletin data showed.

story continues

–With assistance from Philip Lagerkranser.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP