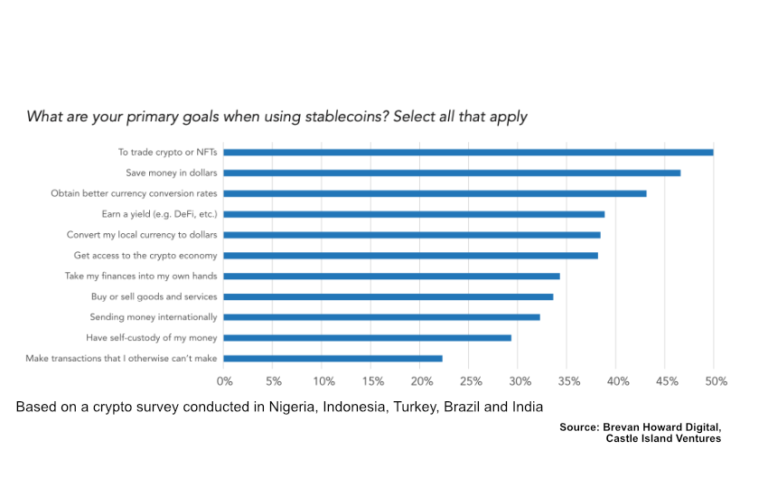

The YouGuv study, commissioned by Brevan Howard Digital and Castle Island Ventures, aimed to examine stablecoin usage in five emerging market countries: Nigeria, Indonesia, Turkey, Brazil, and India. The results show that cryptocurrencies remain the top use case for stablecoins (50%). However, access to dollars came in a close second at 47%, and generation yield came in third (39%). The study involved 500 existing cryptocurrency users from each country.

There is some anecdotal evidence that stablecoins are being used to access dollars and for regular transactions, but so far it has been difficult to pinpoint. The desire to access money was evident in the survey. While there are certainly uses for cross-border payments, it only comes in as the ninth biggest driver for stablecoin adoption, despite 32% rating it as one of their main purposes. It was.

Another set of questions aimed to explore non-cryptocurrency use cases by asking if someone had done it at least once. Almost 40% of respondents have used stablecoins to pay for traditional goods and services or for cross-border P2P payments. 30% have used stablecoins in their business, and 23% have received or paid a salary at least once. We wanted to know which of these activities are regular.

Access to stablecoins and dollars

Our report on bank stablecoins and tokenized deposits briefly discusses the topic of using cross-border stablecoins for financial inclusion (see below). Because of that work, we were initially confused by the table below showing stablecoin holdings.

Nigeria’s relatively high stablecoin holdings makes sense. But I wondered why Türkiye isn’t similar either. Compared to other countries surveyed, these countries have two things in common. That is, both have extremely weak currencies and extremely high remittance costs. we figured it out. The main difference is that Turkish banks offer foreign currency accounts, so dollar stablecoins compete with dollar bank accounts. Most Nigerians (and Africans more generally) do not have that luxury.

This week, Ledger Insights will publish a report on bank-issued stablecoins and tokenized deposits, featuring over 70 projects. Sign up to receive release notifications.