(Bloomberg) — U.S. stocks rose as traders weighed positive economic data against the prospect of escalating conflict in the Middle East. Oil and the dollar rose.

Most Read Articles on Bloomberg

The S&P 500 fell 0.2% and the Nasdaq 100 ended the day modestly lower after choppy trading for much of the morning. The mood on Wall Street soured following President Joe Biden’s cryptic comments about whether he supports Israel attacking Iranian oil facilities.

Oil indexes soared. Brent crude rose above $77 a barrel, its longest daily rise since August, and West Texas Intermediate rose above $73. Investors fear that if Israel attacks important Iranian assets, the Islamic Republic could lash out and escalate the conflict, involving more countries and disrupting global energy transport. are.

That sent the main U.S. stock benchmark heading for its first weekly decline in four years as the world waits for Israel’s response to the Iranian missile attack. Israeli warplanes bombed Beirut overnight after eight soldiers were killed in battles with Hezbollah in southern Lebanon. The VIX index, Wall Street’s fear gauge, resumed its rise, warning of further stock volatility.

“The VIX shows we’re still in the midst of an ‘uncertain October,'” Fundstrat’s Thomas Lee said. But he added, “Ultimately, investors are counting on this bull run,” given several historical factors that favor the S&P 500 index.

Stocks briefly erased losses in early trading after a report showed the U.S. services sector expanded at the fastest pace since February 2023 in September. The Institute for Supply Management’s service index rose to 54.9, better than expected. Measurements above 50 indicate expansion.

Other data showed U.S. claims for unemployment benefits rose slightly last week to a level consistent with a limited number of layoffs. The number of continuing applications, which measures the number of people receiving benefits, was little changed from the previous week’s 1.83 million, according to data released Thursday by the Labor Department.

“September statistics were all solid,” said Abiel Reinhart of JPMorgan Chase & Co. Initial jobless claims “remain fairly low overall, which bodes well for the job market,” he said in a research note.

story continues

International conflicts are once again driving the market, said Michael Metcalf, head of macro strategy at State Street Global Markets. “The market is tight, and I don’t think that’s particularly good for U.S. stocks, so there may be pressure to rebalance,” he said.

Amid heightened geopolitical uncertainty, investors are looking for further signals about the health of the U.S. economy ahead of Friday’s release of the monthly jobs report. The unemployment rate is expected to remain flat at 4.2% in September, while the number of employed people is expected to increase by 150,000.

“Obviously we’re nervous about tomorrow’s jobs report,” Peel Hunt chief economist Callum Pickering said on Bloomberg TV. “If the unemployment rate rises, I wouldn’t be surprised if the market returns to its 50 basis point forecast. The question then is how the Fed will react.”

BMO’s Beil Hartman expects Friday’s numbers to leave the Fed’s next policy undecided. “NFP simply raises or lowers the Fed’s remaining data base to justify a much larger next rate cut.”

On the labor front, investors are hoping for progress toward resolving the longshoremen’s strike that has shut down key U.S. ports. Cowen analyst Jason Seidl said a resolution could be reached by Monday, citing a conference call with panelists that was “close to a port strike.”

In corporate news, Tesla Inc. has stalled after executives resigned ahead of next week’s unveiling of driverless robotaxis. Levi Strauss shares fell after the company lowered its full-year sales growth forecast.

Bloomberg’s dollar index rose for a fourth straight day, supported by rising U.S. Treasury yields. Sterling is on track for its worst pace since 2022 after Bank of England officials suggested the central bank could take a more aggressive approach to cutting interest rates.

This week’s main events:

The main movements in the market are:

stock

As of 4 p.m. New York time, the S&P 500 was down 0.2%.

Nasdaq 100 almost unchanged

The Dow Jones Industrial Average fell 0.4%.

MSCI World Index falls 0.3%

currency

Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.2% to $1.1028.

The British pound fell 1.1% to $1.3122.

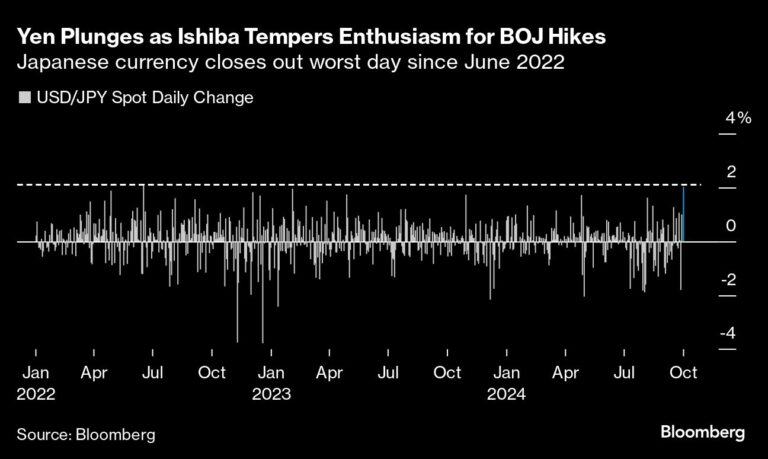

The Japanese yen fell 0.3% to 146.88 yen to the dollar.

cryptocurrency

Bitcoin is little changed at $60,964.44

Ether fell 1.4% to $2,352.11.

bond

The 10-year Treasury yield rose 7 basis points to 3.85%.

Germany’s 10-year bond yield rose 5 basis points to 2.14%.

UK 10-year bond yields fell 1 basis point to 4.02%.

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Winnie Hsu, John Cheng, Chiranjivi Chakraborty, Robert Brand, Margaryta Kirakosian, and Sujata Rao.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP