MicroStrategy Inc.’s MSTR closed Friday as the sixth-most traded stock on Wall Street, prompting founder and CEO Michael Thaler to coin the term “Magnificent Eight.” I made it and celebrated it.

What Happened: On Sunday, Saylor took on X, drawing attention to the Bitcoin BTC/USD developer’s latest feat.

MicroStrategy posted $5.8 billion in trading volume on Friday, trailing only tech giants such as Tesla Inc. TSLA, Nvidia Corp. NVDA, Apple Inc. AAPL, Microsoft Corp. MSFT, and Meta Platforms Inc. META.

Moreover, MicroStrategy’s trading volume was higher than the other two companies in the “Magnificent 7”, Amazon.com Inc. AMZN and Alphabet Inc. GOOG GOOGL.

As is well known, the term “Magnificent 7” refers to a group of seven high-performing and influential American companies. These seven stocks alone have a total market capitalization of $16.5 trillion.

The term “Magnificent 8”, coined by Thaler, was intended to reflect MicroStrategy’s growth, which outpaced the “Magnificent 7” companies with year-to-date (YTD) returns of 238%.

Five of the seven tech giants are scheduled to report third-quarter results later this week, with Tesla releasing numbers last week and Nvidia expected to report financials in November.

SEE ALSO: Satoshi Nakamoto’s Identity Prediction Market Looks More Volatile than Bitcoin: Sassaman Dethrones Peter Todd.

Why it matters: The spike in trading volume comes amidst MicroStrategy’s Bitcoin strategy, sparking interest from companies with much larger valuations.

Last week, Microsoft shareholders proposed investing in Bitcoin, citing the example of MicroStrategy’s stock outperforming the tech giant in 2024.

MicroStrategy adopted Bitcoin as its primary reserve asset in 2020, becoming the first publicly traded company to pursue this strategy. The company has doubled its Bitcoin purchases and now has more than $17 billion in Bitcoin on its books, according to bitcointreasuries.net.

Price Trend: At the time of writing, Bitcoin was trading at $68,289.13, up 2.06% in the past 24 hours, according to data from Benzinga Pro. MicroStrategy stock closed 0.66% lower at $234.34 on Friday.

Read next:

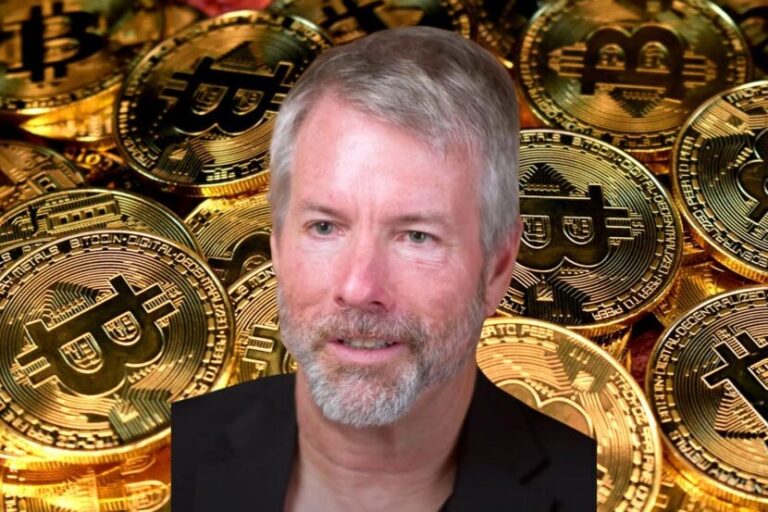

Photo credit: Wikimedia

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.