Bitcoin rallied sharply this week as Bitcoin analysts warned that “something has to give.”

$3,000 that gives you unparalleled access to Web3’s community of top entrepreneurs, creators, investors, premium networking, priority access to global events, free access to Forbes.com and Forbes CryptoAsset & Blockchain Advisor newsletters, and more Get more benefits. Apply now!

Bitcoin prices plunged earlier in the week, even as JPMorgan analysts quietly predicted that so-called “downside trades” could fuel a Bitcoin price boom ahead of the US election It has since recovered to over $60,000 per Bitcoin.

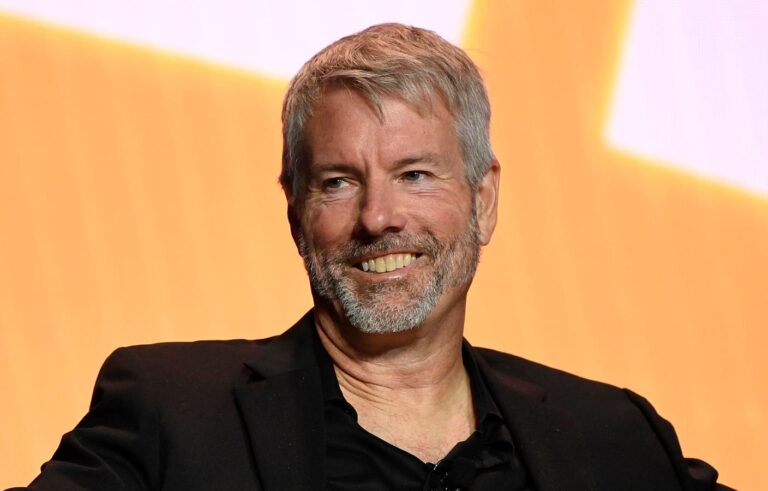

Now, after a surprising turn in the mystery of Bitcoin founder Satoshi Nakamoto, MicroStrategy’s founder and executive chairman Michael Saylor has revealed that the company’s ultimate goal is to become a Bitcoin investment bank, with up to $150 billion. revealed that it is to buy Bitcoin.

Sign up for your free CryptoCodex today. A daily 5-minute newsletter for traders, investors, and crypto enthusiasts to stay informed and ahead of bull runs in the Bitcoin and crypto markets.

Forbes Donald Trump’s ‘major’ China nightmare suddenly becomes reality By Billy Bumbrough

MicroStrategy founder Michael Saylor has capitalized on the Bitcoin price boom and turned his software company into a… (+) Bitcoin purchase vehicle.

Getty Images for Bitcoin Magazine

“(Bitcoin) is the most valuable asset in the world,” said Gautam, Bernstein’s digital assets leader, who started buying bitcoin in 2020 at the software-turned-bitcoin acquisition company. – Chugani told Bernstein analysts in an interview. A memo to clients seen by The Block.

“The ultimate goal is to become a major Bitcoin bank, or merchant bank, or Bitcoin financial company,” Saylor said, adding that MicroStrategy has developed Bitcoin capital markets products across stocks, convertibles, bonds and preferred stocks. are.

“If you end up converting $20 billion, $20 billion of preferred stock, $10 billion of debt, and another $50 billion of some kind of debt and structured products, you have $100 billion to $150 billion in Bitcoin. I will put it in.”

Saylor amassed more than 252,000 Bitcoins worth $15.7 billion at MicroStrategy by issuing bonds to fund Bitcoin purchases. This strategy could mean MicroStrategy receives a “margin call” for additional capital if the price of Bitcoin falls below a certain value. level, but Saylor plans to continue.

“I think it’s infinitely scalable,” Thaler replied. “There’s no question about how we can raise another $100 billion and then $200 billion. It’s a $1 trillion asset class that becomes $10 trillion, then $100 trillion. The risk is very high. It’s simply Bitcoin. Either you believe Bitcoin is something, or you believe it is nothing.”

While other companies that have dabbled in bitcoin, including Elon Musk’s Tesla and Wall Street giant BlackRock, have used profits to fund operations or take fees from customers, Saylor’s The strategy is simpler.

Sign up for CryptoCodex today. A free daily newsletter for anyone interested in cryptocurrencies.

Forbes Tesla Billionaire Elon Musk warns of $35 trillion US ‘bankruptcy’ – predicts Bitcoin price boomWritten by Billy Bambrough

Bitcoin prices have soared this year, and MicroStrategy’s stock price has increased by a whopping 500% over the past 12 months.

forbes digital assets

“We just keep buying more Bitcoin,” Saylor said. “Bitcoin is going to be worth millions of dollars per coin, and we’re going to build a trillion-dollar company,” he said, adding that Bitcoin’s price will rise from 0.1% to 7% of global financial capital. % and will reach $13 million by 2045. .

MicroStrategy’s stock price has soared along with Bitcoin prices over the last year, as it attracts buyers who want Bitcoin exposure but don’t want to pay the fees associated with a new spot Bitcoin exchange-traded fund (ETF). exceeded the coin. It debuted earlier this year.

The price of Bitcoin has increased by 50% since January, and MicroStrategy’s stock price has increased by over 200%.

“Relative to Bitcoin, (MicroStrategy’s) stock is at its highest level since 2019,” Rob Ginsburg, managing director at Wolfe Research, said in a note to clients viewed by CNBC. ”, he warned that stocks were overbought and recommended MicroStrategy’s “tactical hedging.” You can earn profits by purchasing Bitcoin directly.