(Bloomberg) – Stock futures suggest Wall Street is slightly softer as traders wait for inflation data to show whether the Federal Reserve will choose a slower pace of rate cuts. did.

Most Read Articles on Bloomberg

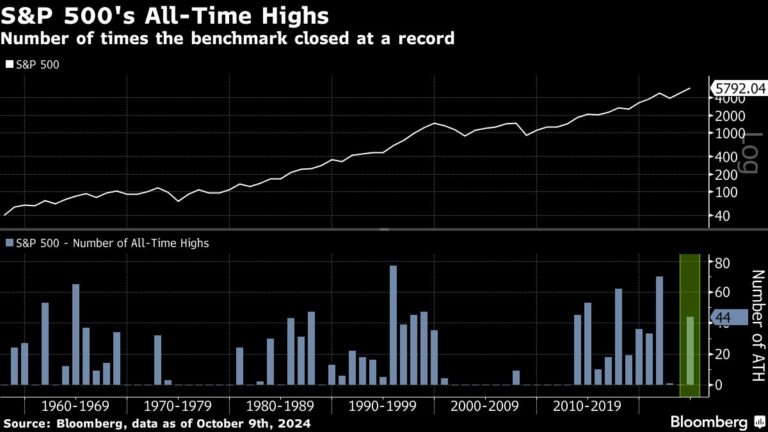

Contracts on the S&P 500 fell 0.2% after the index hit a record high on Wednesday. The yield on the 10-year U.S. Treasury rose above 4%, near its highest level since late July. The Bloomberg Dollar Index held firm after eight straight days of gains, the longest since April 2022.

Inflation is expected to slow further in September’s U.S. consumer price data, supporting the view that the Fed will continue accommodative policy in the coming months. But last month’s surprisingly strong jobs report forced traders to back off bets on a rate cut, with many expecting a 25 basis point cut in November.

Benedict Lowe, a strategist at BNP Paribas Markets 360, said on Bloomberg TV that the Fed’s response capabilities could change if inflation indicators remain strong.

“Given that U.S. stock prices are near all-time highs and European stocks are near multi-year highs, the risks are even more to the downside if inflation picks up from here,” Lowe said.

Meanwhile, Delta Air Lines started its third quarter earnings season with profit and revenue estimates falling short of expectations. JPMorgan Chase and Wells Fargo are scheduled to report on Friday.

Investors will be waiting to see whether profits are strong enough to sustain the S&P 500’s roughly 20% gain this year. Companies included in the index are expected to see quarterly profits rise 4.7% from a year ago, according to data compiled by Bloomberg Intelligence. This has been revised downward from the 7.9% growth forecast as of July 12th.

Brian Levitt, global market strategist at Invesco, expects the rally to continue as companies outpace expectations for contraction.

“Nominal growth is a good backdrop, and investors are sitting there looking at the stock market and saying, ‘The stock market is at an all-time high, but should I invest?'” Levitt told Bloomberg TV. told. “Peak inflation, peak tightening and peak interest rates should be positive for stocks.”

Among the stocks moving on Thursday, U.S. insurance stocks rose in premarket trading after Hurricane Milton weakened to a Category 3 storm, and supply chain services provider GXO Logistics rose on news of a possible sale. It rose in response. Pharmaceutical company Pfizer has been ousted after two former executives decided not to join an activist movement against the company.

story continues

In Europe, the Stoxx 600 index was little changed. Brent crude oil futures rose above $77 a barrel on concerns that Israeli retaliation for recent missile attacks on Iran could spark an all-out war in the Middle East.

This week’s main events:

US CPI, new unemployment claims, Thursday

Fed’s John Williams and Thomas Barkin speak on Thursday

JPMorgan and Wells Fargo kick off earnings season for big Wall Street banks on Friday.

US PPI, University of Michigan Consumer Sentiment, Friday

Fed’s Laurie Logan, Austan Goolsby and Michelle Bowman speak on Friday

The main movements in the market are:

stock

As of 7:45 a.m. New York time, S&P 500 futures were down 0.1%.

Nasdaq 100 futures fell 0.2%

Dow Jones Industrial Average futures little changed

Stoxx Europe 600 has little change

MSCI World Index little changed

currency

Bloomberg Dollar Spot Index little changed

The euro was almost unchanged at $1.0930.

The British pound was almost unchanged at $1.3070.

The Japanese yen rose 0.2% to 149.08 yen to the dollar.

cryptocurrency

Bitcoin rose 1.3% to $61,188.01

Ether rose 2.1% to $2,402.92

bond

The 10-year Treasury yield rose 2 basis points to 4.09%.

Germany’s 10-year bond yield rose 3 basis points to 2.28%.

UK 10-year bond yields rose 6 basis points to 4.24%.

merchandise

West Texas Intermediate crude rose 1.2% to $74.11 per barrel.

Spot gold rose 0.2% to $2,612.67 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Catherine Bosley, Subrat Patnaik, and John Viljoen.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP