Market sentiment has shifted from bullish optimism, with investors aggressively buying the dip, to a more cautious and fearful approach, with many investors selling at any sign of recovery. It has become.

emotional market sentiment

Market reactions to news are often colored by emotional reactions, whether positive or negative. For example, increased investor confidence can lead to sharp increases in prices and, in some cases, to overvaluation. Conversely, if prices start to fall, investors may liquidate their holdings out of fear to minimize losses.

While this emotional volatility can pose challenges, it can also present unique buying opportunities for those who thoughtfully analyze market conditions.

Given the current uncertainty, investors are advised to consider technical indicators such as the ‘death cross’. This typically signals a transition from bullish to bearish market conditions.

Death Cross & Golden Cross Evaluation

A death cross occurs when the short-term moving average falls below the long-term moving average. This is often represented by the 50-day moving average falling below the 200-day moving average. This technical formation often serves as a harbinger of further market decline.

Conversely, a golden cross occurs when the 50-day moving average crosses above the 200-day moving average, indicating a bullish setup.

Also read: Is this the end of the bull market?

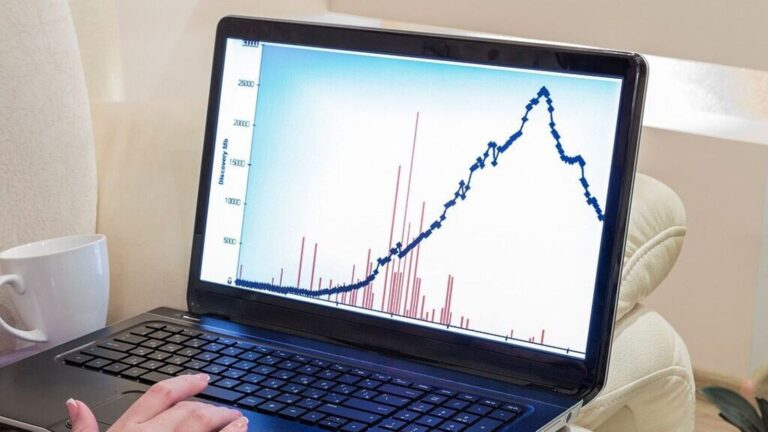

To understand the context of death and golden crosses in the current market environment, let’s examine the spread of this signal across various indices.

Show full image

Source: RZone, Definage Securities

These numbers show that while some stocks are exhibiting bearish trends, a significant number of stocks remain resilient and bullish even during market corrections. The presence of golden cross formations in other stocks highlights the potential for upward momentum.

Readers should understand that the stock could trade below the 50DMA and 200DMA at the Golden Cross, but this does not support a bearish reversal.

Also read: 3 companies with high dividend payout potential

Market trends and retracements

It is important to realize that the stock market does not move in a straight line. These experience fluctuations known as retracements, creating opportunities for the overall trend.

According to Dow Theory, market movements can be divided into major trends, which represent long-term direction, and intermediate trends, which reflect short-term fluctuations. Retracements often represent temporary reversals or consolidations, giving investors an opportunity to reevaluate their strategies.

The Nifty500 chart reveals some interesting setups that could impact market sentiment.

Show full image

Source: RZone, Definage Securities

The rise/fall ratio is currently in the oversold zone, often indicating a possible reversal. The rise-fall line measures the balance between rising and falling stocks. As per historical patterns, a dip of the AD line below 10 could portend a reversal in momentum, especially for the Nifty500.

Given that the Nifty500 index is above its long-term 200-day exponential moving average (DEMA), the current price drop is not an immediate cause for concern and can be interpreted as a typical market move. This positioning could lead investors to view economic downturns as potential buying opportunities.

Read Profit Pulse for more analysis like this.

Maintaining a balanced outlook is important during the current market volatility, as fear influences emotions and can ultimately lead to rash decisions. However, it is important to recognize the potential opportunities from the long-term trends that these adjustments may bring.

A potential market reversal may be on the horizon as the Nifty500 is trading above its 200-day exponential moving average and the rising/falling line indicates an oversold situation. Nevertheless, the subsequent actions of foreign institutional investors will play an important role in shaping future market dynamics. While the reversal may once again attract optimistic investors, it is essential to tread carefully, as unchecked greed can lead to risky decisions.

Note: The purpose of this article is solely to share interesting charts, data points, and thought-provoking opinions. It is not recommended. If you would like to consider investing, we strongly recommend that you consult an advisor. This article is strictly for educational purposes only.

As per Sebi guidelines, the author and his/her dependents may or may not own stocks, commodities, virtual currencies and other assets discussed herein. However, Definedge’s clients may or may not own these securities.

Brijesh Bhatia has over 18 years of experience in the Indian financial markets as a trader and technical analyst. He has worked with UTI, Asit C Mehta, Edelweiss Securities and others. Currently, he is an analyst at Definedge.

Disclosure: The author and his dependents do not own any stocks discussed here. However, Definedge’s clients may or may not own these securities.