Every quarter, investment companies with $100 million or more under management file Form 13F with the Securities and Exchange Commission (SEC). I feel that the 13F is a valuable tool because it provides a detailed analysis of which stocks are being bought and sold by institutional investors. It might also be interesting to identify patterns among Wall Street’s largest asset managers.

One investor I enjoy following is Jeff Yass, co-founder of Susquehanna International Group (SIG). SIG purchased approximately 5 million shares of artificial intelligence (AI) stock Super Micro Computer (NASDAQ: SMCI) during the second quarter, increasing its position in the company (also known as Super Micro) by 148%.

Below, we break down how Supermicro’s position in the AI space works and discuss some important topics to consider when investing in the company.

Supermicro often comes up when semiconductor companies like Nvidia and Advanced Micro Devices are mentioned. Because of this, many investors think of Supermicro as just another chip stock, but this is actually not accurate.

Supermicro is an IT infrastructure business that specializes in designing storage architectures for Nvidia and AMD graphics processing units (GPUs). Therefore, while chip industry demand directly affects Supermicro’s operations, the company itself is not a true semiconductor stock.

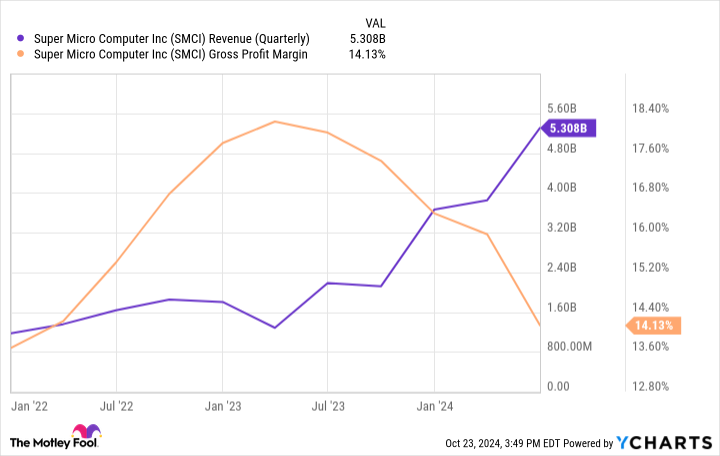

There’s no doubt that Supermicro is benefiting from AI tailwinds, but the financials below illustrate a rather harsh reality.

SMCI Revenue (Quarterly) Chart

In other words, Supermicro’s gross margins are trending in the wrong direction. Despite consistent acceleration across the top line, Supermicro’s unit economics have regressed considerably.

Although executives say these headwinds won’t last long, the reality is that IT infrastructure is not a high-margin industry. This dynamic leads to my next key theme: the risks of competition and commoditization.

Supermicro has done an admirable job of fostering relationships with the world’s leading GPU manufacturers, but these relationships are by no means exclusive.

Supermicro competes with many other companies that provide IT architecture solutions, including Dell Technologies, Hewlett Packard Enterprise, Lenovo, and Cisco. These companies are much larger and more diverse than Supermicro, making them formidable competitors.

Broadly speaking, when many players within the same industry offer the same solution, companies are forced to compete on price. Therefore, although Supermicro’s management is predicting an increase in operating profit, I wonder how profitable the company will be as competition increases.

story continues

Image source: Getty Images.

I think the biggest topic for investors to be aware of when considering investing in Supermicro is the allegations against the company by Hindenburg Research. Hindenburg is a short seller, meaning the company has a financial interest in the stock’s decline.

SMCI chart

Supermicro stock has fallen 16% since Hindenburg released its short-term report on Aug. 27.

In summary, Mr. Hindenburg alleges that Supermicro’s financial management and accounting practices contain errors, perhaps intentionally. Considering Supermicro actually ended up postponing its annual report, it’s clear why some investors sold their shares and moved on. Equally concerning is a report in the Wall Street Journal that the U.S. Department of Justice is taking note of Hindenburg’s claims.

However, Hindenburg’s claims have yet to yield any concrete information, and the apparent drop in stock prices appears to be more rooted in fear than anything concrete.

Supermicro is currently trading at a forward price/earnings ratio of approximately 13.5 times. As the chart below shows, Supermicro’s valuation multiple has worsened in recent months amid increased speculation about the company’s future.

SMCI PER (futures) chart

I can see how suspicions about the company could fuel panic selling. On the other hand, Supermicro’s long-term profitability outlook is difficult to predict due to the crowded competitive environment. Still, I see Supermicro continuing to be an important business in the IT infrastructure world.

In the short term, I think the most obvious catalyst for Supermicro is the planned launch of Nvidia’s Blackwell GPU architecture. Additionally, I have a hard time buying the argument that Supermicro isn’t well-positioned long-term as companies continue to pour billions into AI infrastructure like data centers, network connectivity solutions, and GPUs.

While I understand the risks surrounding Supermicro, I view the company’s declining valuation as a unique opportunity to acquire shares of a growth stock at a more affordable price.

Have you ever felt like you missed out on buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our team of expert analysts will issue a “Double Down” stock recommendation on a company we think is about to crash. If you’re already worried that you’re missing out on an investment opportunity, now is the best time to buy before it’s too late. And the numbers speak for themselves.

Amazon: If you invested $1,000 when it doubled in 2010, you would have earned $21,154. *

Apple: If you invested $1,000 when it doubled in 2008, you would have earned $43,777. *

Netflix: If you invested $1,000 when it doubled in 2004, you would have earned $406,992. *

We currently have “double down” alerts on three great companies, and we may not see an opportunity like this again anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor will return as of October 21, 2024

Adam Spatacco holds a position at Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Cisco Systems, and Nvidia. The Motley Fool has a disclosure policy.

Billionaire Jeff Yass increased his position in this very cheap artificial intelligence (AI) stock by 148%. Here are three things smart investors should know. Originally published by The Motley Fool