Polymarket (a decentralized prediction market) has been a huge success for the Polygon blockchain in that it is an app that has broken out organically and is gaining mainstream usage and attention.

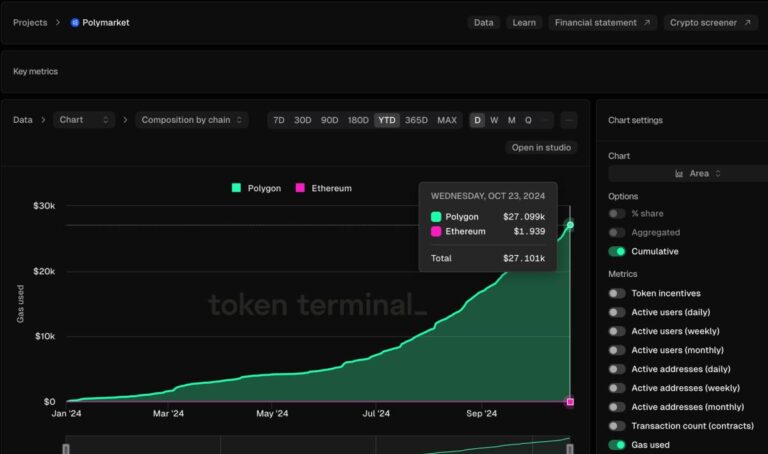

However, data shows that Polymarket will generate only $27,000 in fees on Polygon’s PoS blockchain in 2024.

Polygon Labs CEO Marc Boiron agrees that $27,000 is a low number, but argues that it shows how cheap using blockchain is, which is a selling point. Transaction fees at Polygon are approximately $0.007, well below the sub-cent threshold that some teams are targeting.

Boiron argues that apps like Polymarket are not expected to generate significant revenue from transaction fees, as would be expected from transaction-intensive applications such as decentralized cryptocurrency exchanges.

Layer 2 Blockchain One of the big successes this year for the team behind Polygon is Polymarket. Polymarket is a decentralized prediction market that has seen users flock to it this year to bet on everything from presidential politics to the ending of an HBO documentary.

What is less clear to crypto analysts who follow Polygon’s performance metrics is whether the coup will bring relief to holders of the project’s beleaguered tokens, which have declined 65% this year.

Polymarket is rapidly gaining popularity among mainstream users and allows you to bet on the upcoming US presidential election. Polymarket bettors added nearly $2.4 billion on whether Donald Trump or Kamala Harris would win in November’s election. More recently, some people have placed bets on who inventor Satoshi Nakamoto is in a recently released HBO documentary about Bitcoin.

Polymarket is built on the Polygon PoS blockchain, and the application is one of the first major organic successes for a team known for its past marketing strategy of paying partners like Starbucks to use the network. .

So, given the skyrocketing usage of this application, why did it generate so little money for the Polygon team and the price of the native POL token barely increased?

As of October 23, Polymarket has only brought in about $27,000 in Polygon PoS transaction fees in 2024, according to Token Terminal data.

Cumulative gas costs in Polymarket’s Polygon PoS for 2024 totaled just over $27,000 this year through October 23rd. (token terminal)

Part of the answer is that fees are market-based. And recently, trading on Polygon PoS has become very cheap.

The average transaction fee on the Polygon PoS chain on the same day was $0.007.

Polygon PoS (Token Terminal) Average Transaction Fee

Every time a Polymarket user places a bet, a transaction is created on Polygon PoS. As part of these transactions, you pay a fee to the PoS. Rates are divided into basic rate and priority rate. Base fees are not paid to validators. Instead, it is baked and sent to a null address, which should theoretically benefit token holders by reducing supply.

story continues

“That base fee is adjustable and based on network congestion,” Polygon Labs CEO Marc Boiron told CoinDesk in an interview. “So when the network gets congested, that base price increases.”

Priority fees are paid to validators.

“You’re paying a validator to say, ‘Please put me on a block.’ The higher the fee you pay, the faster the validator can block you if there’s more traffic.” They will let you in,” Boisron added.

If you have enough block space, you will need to pay less.

Another problem is that, in the grand scheme of things, Polymarket bettors are very active, but trading volumes are nowhere near the levels of high-intensity applications like decentralized crypto exchanges (DEXs).

According to Polygon’s research team, 5.2% of transactions on the Polygon PoS chain came from Polymarket so far this month. Chainlink accounts for 10.38% of transactions on PoS, and stablecoin USDT transfers account for 4.89%.

Polygon PoS transaction breakdown. Polymarket is part of the ‘Other category’, as confirmed by Polygon research. (Dune/Polygon)

Let’s take a recent day’s activities as an example. On October 23rd, Polymarket accounted for approximately 8% of the “gas” used in Polygon PoS, based on data from blockchain explorer PolygonScan. This made him the largest individual contributor. In blockchain terminology, gas is a measure of the computational intensity required for a particular batch of transactions.

“I look at how it’s built,” Boiron said. “Polymarket doesn’t have a ton of configuration features like Uniswap, so don’t expect a lot of fees. There are some, but not a lot. The only people who are actually there are the users who make the transactions. It runs and then stops. So it’s essentially not going to be that popular until the number of users increases significantly.”

Polygon has long sought a mainstream breakthrough moment, pouring millions of dollars into partnerships with Starbucks and Meta to bring Web3 to the masses. These deals never actually materialized.

The Polygon team is encouraged by the significant traction Polymarket is receiving and hopes that this traction will spread to more people in the broader Polygon ecosystem.

Boisron told CoinDesk: The obvious reason is simply to warn you. ”

This success “shows that you can have incredibly successful apps on PoS and make it almost imperceptible that you’re even using blockchain,” he said.

On the bright side, “Frankly, paying only $20,000 in transaction fees just shows how cheap it is to use Polygon PoS,” Boiron said.

He said Polymarket’s organic explosion contributed to Polygon’s success as it brought attention to the ecosystem.

“Different applications have different roles. For me, Polymarket’s role includes: We give them very cheap transactions that make it very easy.” What it brings us is attention, which is added value. ”

“This is very different from someone building an order book DEX in PoS. If they were paying $20,000 in fees over multiple months, that would be a big failure. When you expect orders to be placed, canceled, and filled, you’re going to end up with a huge number of transactions. So the key thing here is that each application has a different purpose.”

Read more: Polymarket reportedly seeks $50 million in funding, considers tokens as election betting soars

UPDATE (18:17 UTC): Add bullet points to the beginning of the story.