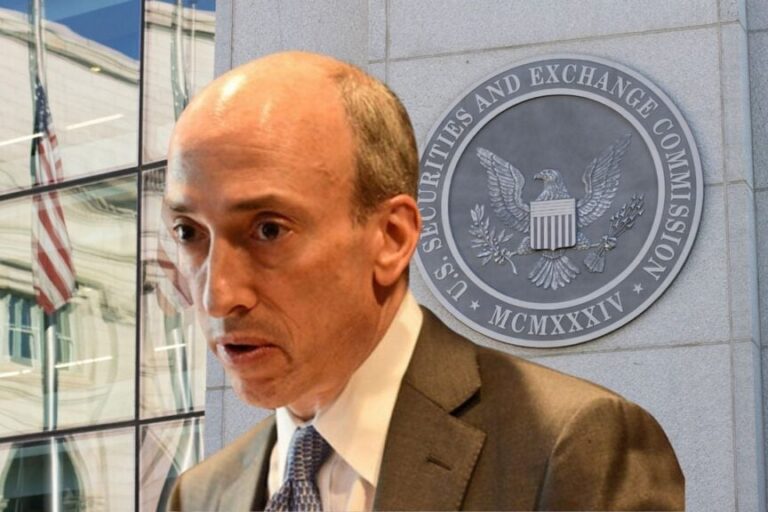

Tusk Ventures CEO Bradley Tusk has taken a strong stance against U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler and his handling of cryptocurrency regulation.

What Happened: In an interview with CNBC, Tusk expressed dissatisfaction with Gensler’s approach to crypto regulation. He pointed to the issue of lack of clarity on what is considered legal in the cryptocurrency space, arguing that this ambiguity is hindering innovation. He went so far as to call Gensler “the worst regulator in the history of cryptocurrencies.”

Tusk also touched on the ongoing disagreement between the Commodity Futures Trading Commission (CFTC) and the SEC over crypto regulation. He, like many others in the industry, supports the CFTC’s approach of treating cryptocurrencies as commodities.

The venture capitalist predicts that a change in SEC leadership could give the industry a much-needed boost. No matter who wins, Tusk believes the election results will be beneficial for crypto investors, as candidates are actively seeking support from the crypto community.

Tusk Ventures holds significant stakes in major cryptocurrency companies such as Coinbase, Circle, and FanDuel.

Also read: Anthony Scaramucci says Donald Trump’s crypto project is a ‘financial scam’ and should be avoided ‘at all costs’

Why it matters: Tusk’s criticism of Gensler’s approach to crypto regulation is not an isolated sentiment. Billionaire entrepreneur Mark Cuban also expressed dissatisfaction with Gensler’s regulatory approach, saying it was pushing the crypto industry overseas and stifling capital market growth.

Mr. Cuban even indicated that he would be open to replacing Mr. Gensler as SEC chairman under a potential Harris administration. Meanwhile, Gensler has expressed doubts about the future of cryptocurrencies and their potential to become a widely accepted form of payment.

What’s Next: Benzinga’s Future of Digital Assets event on November 19th will focus on the fallout from the election on the crypto industry.

Read next:

Image: Shutterstock

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.